RahnaJuly 26, 2023

E-Invoice

India has made significant progress toward implementing electronic invoicing (also known as e-invoicing) and the e-way bill system to standardize and streamline business transactions in the world of commerce that is rapidly going digital. These measures have been introduced to boost transparency, efficiency, and tax compliance.

Odoo is one of the top ERP systems that can meet these needs. In this blog post, we will look at how Odoo makes it easier to implement Indian e-invoicing and e-way bills, facilitating smooth and legal business operations.

Benefits of E-Invoicing

Indian e-invoicing is a transformative system introduced by the Government of India in 2020 under the Goods and Services Tax (GST) framework. The mandate aims to bring about a uniform and standardized format for electronic invoices, eliminating manual processes and enhancing transparency in the entire supply chain.

Implementing E-Invoicing in Odoo

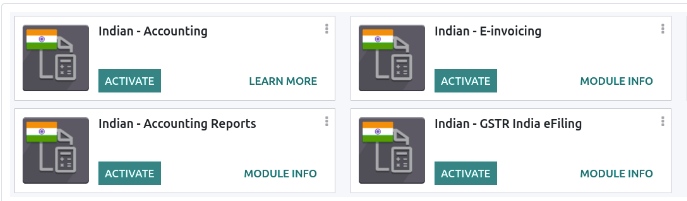

Odoo, being a versatile ERP solution, offers an integrated e-invoicing module compliant with Indian regulatory requirements.

NIC e-Invoice registration

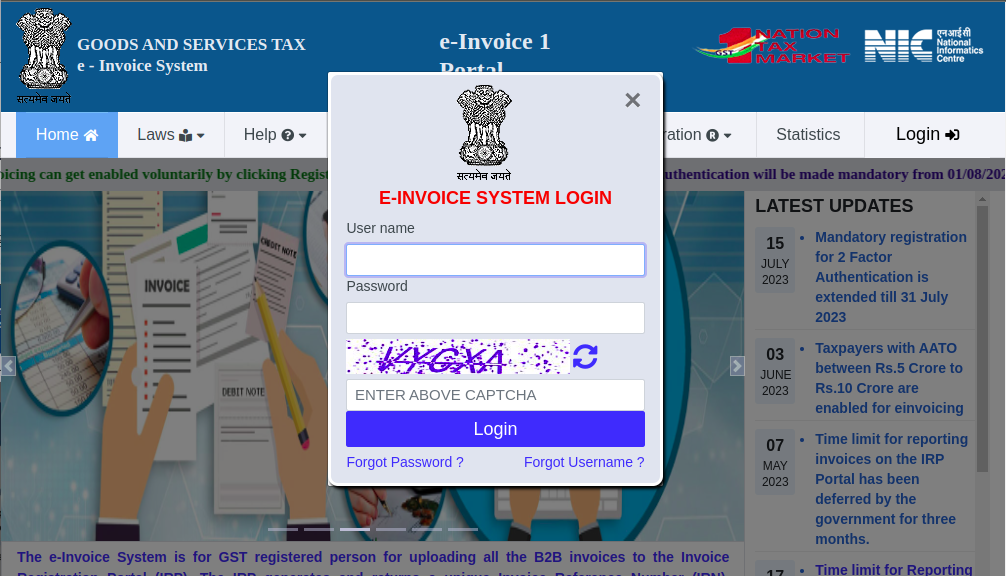

By registering on the NIC e-Invoice Portal, you will get an API Credential, which is used to configure the Odoo Accounting App.

2. From the dashboard, go to API Registration -> User Credentials -> Create API User

3. After that, you should receive an OTP code on your registered mobile number. Enter the OTP code and click Verify OTP

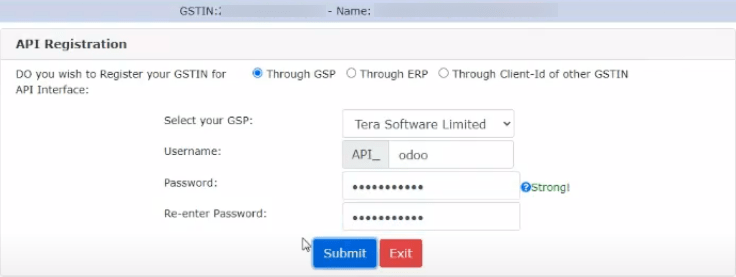

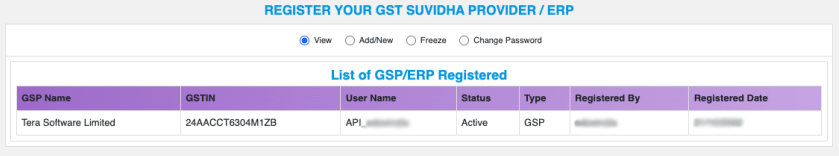

4. Select Through GSP for the API interface, set Tera Software Limited as GSP, and type in

a Username and Password for your API. Once it is done, click Submit.

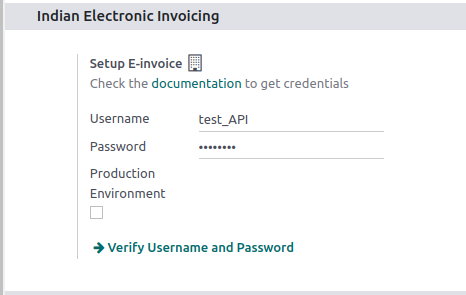

To enable the e-Invoice service in Odoo, go to

Accounting -> Configuration -> Settings -> Indian Electronic Invoicing, and enter the Username

and Password previously set for the API.

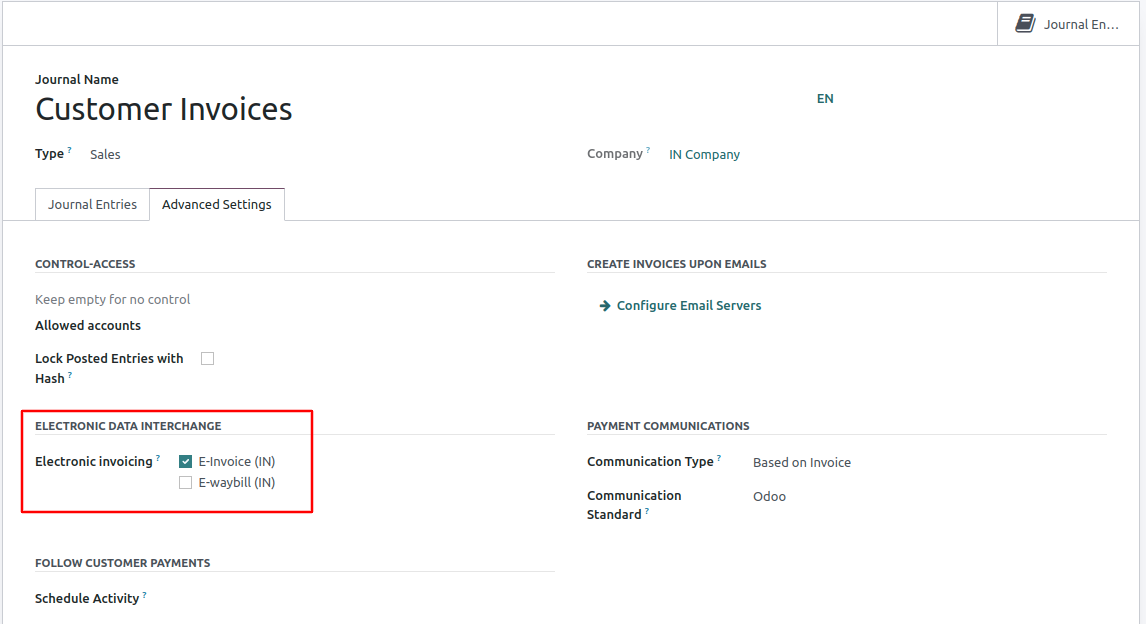

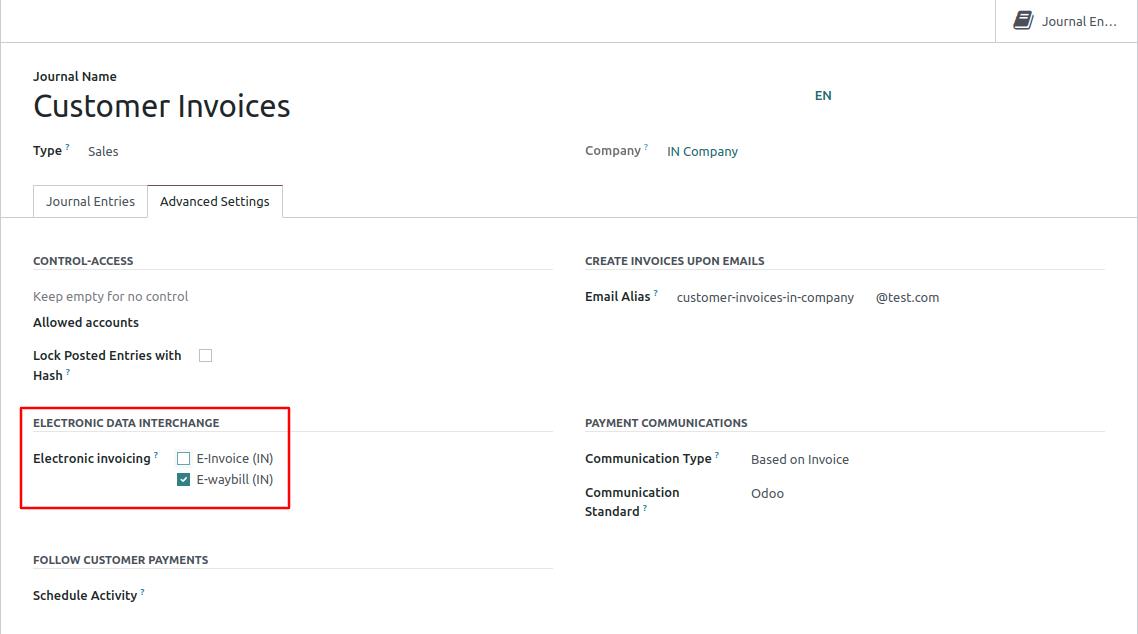

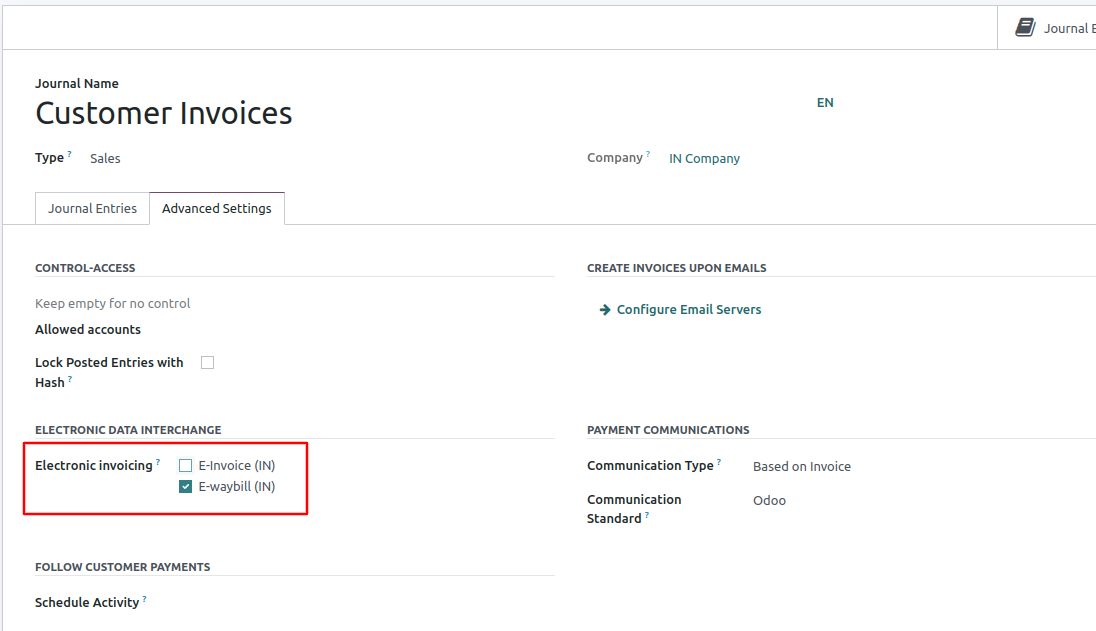

Configuring Journal

To automatically send e-Invoices to the NIC e-Invoice portal, you must first configure your sales journal by going to Accounting -> Configuration -> Journals, open your sales journal, and in the Advanced Settings tab, under Electronic Data Interchange, enable E-Invoice (IN)

Workflow

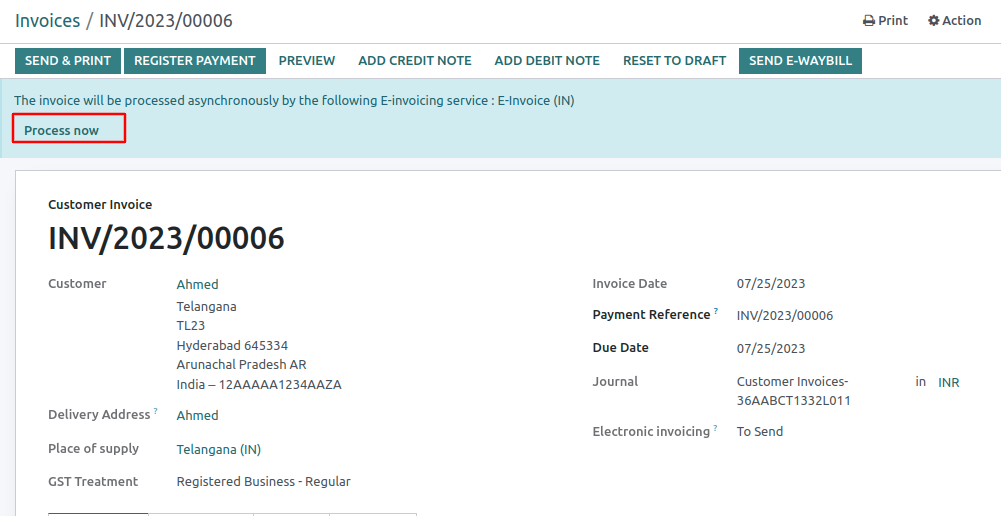

Generate an invoice either via a sale order or through accounting in the normal flow. Once the

invoice is posted, a confirmation message is displayed at the top.

Odoo automatically uploads the JSON-signed file of validated invoices to the NIC e-Invoice portal by the end of the day. If you want to process the invoice immediately, click Process now.

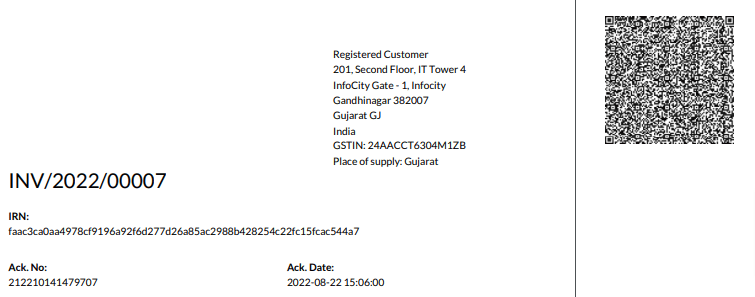

Once an invoice is validated and submitted, the invoice PDF report can be printed. The report includes the IRN, Ack. No. (acknowledgment number), Ack. Date (acknowledgment date), and QR code. These certify that the invoice is a valid fiscal document.

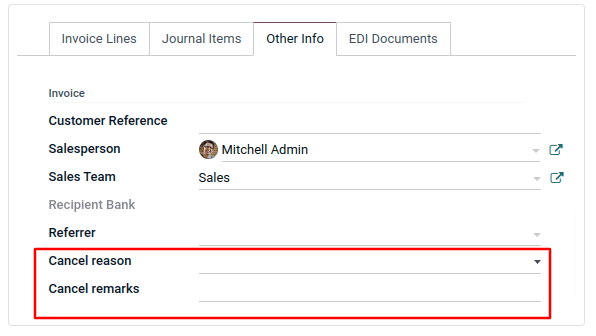

If you want to cancel an e-Invoice, go to the Other info tab of the invoice and fill out the Cancel reason and Cancel remarks fields. Then, click Request EDI cancellation. The status of the Electronic invoicing field changes to To Cancel.

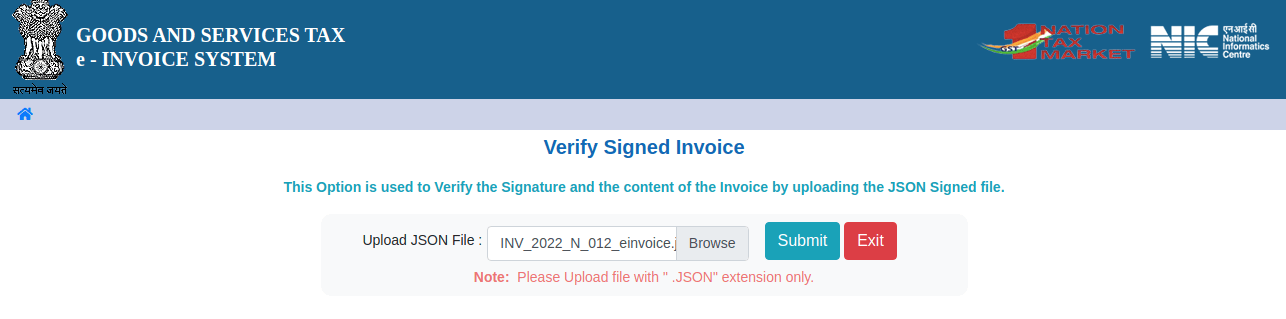

After submitting an e-Invoice, you can verify if the invoice is signed from the GST e-Invoice system website itself.

If the file is signed, a confirmation message is displayed.

E-Way Bill

An e-way bill is a document that is required for the movement of goods worth more than a specified value between different states or within a state in India. It is generated electronically on the government portal (commonly known as the E-way Bill Portal) and is used by tax authorities to track the movement of goods and ensure compliance with tax regulations.

Benefits Of E-Way Billing

Implementing E-Way Billing in Odoo

Activate the e-way billing module in compliance with Indian regulatory requirements.

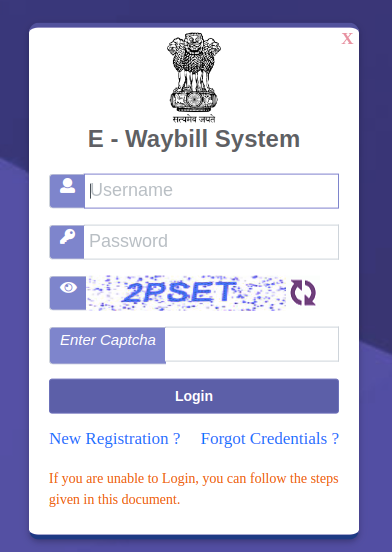

NIC e-Way Bill Registration

By registering on the NIC e-Way bill Portal, you will get an API Credential, which is used to configure the Odoo Accounting App.

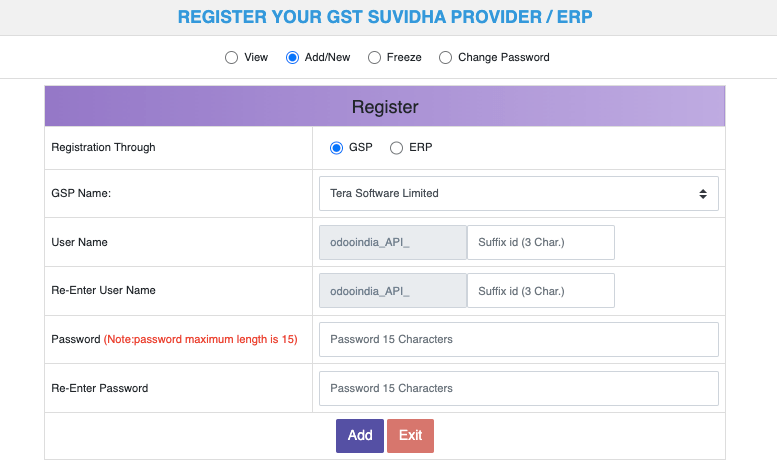

To set up the E-Way bill service, go to Accounting -> Configuration -> Settings -> Indian Electronic WayBill -> Setup E-Way bill, and enter your Username and Password.

Configuring Journal

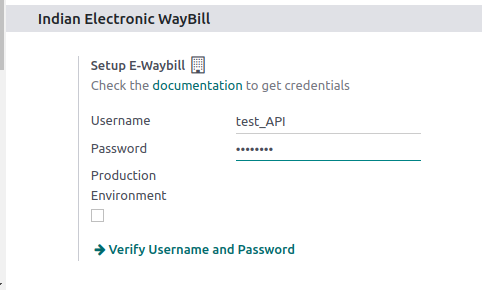

To automatically send e-Way bill to the NIC e-Way bill portal, you must first configure your sales journal by going to Accounting -> Configuration -> Journals, open your sales journal, and

in the Advanced Settings tab, under Electronic Data Interchange, enable E-waybill (IN)

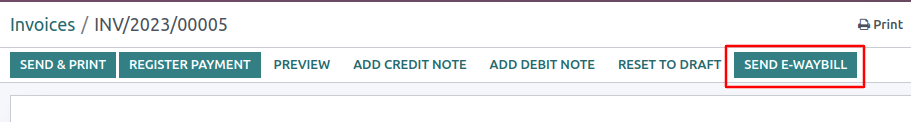

Generate an invoice either via a sale order or through accounting in the normal flow. Once the invoice is posted, you will see an extra tab SEND E-WAYBILL

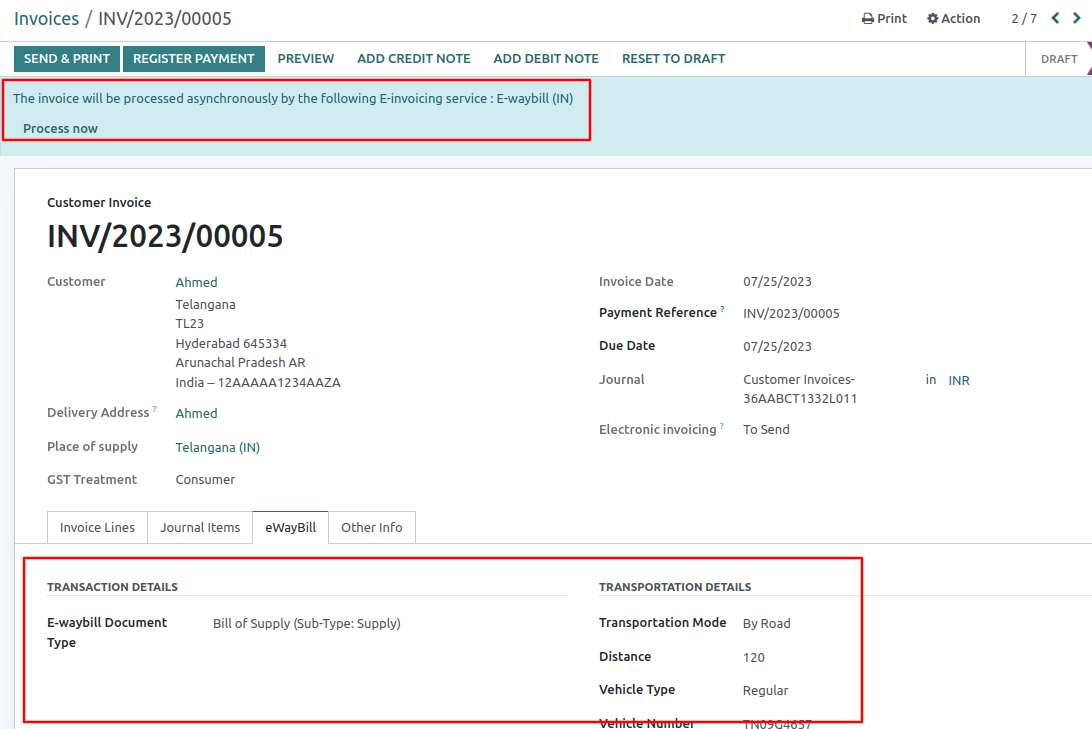

Once an invoice has been issued and sent via Send E-Way bill, a confirmation message is displayed.

Odoo automatically uploads the JSON-signed file of validated invoices to the NIC E-Way bill portal by the end of the day. If you want to process immediately, click Process now.

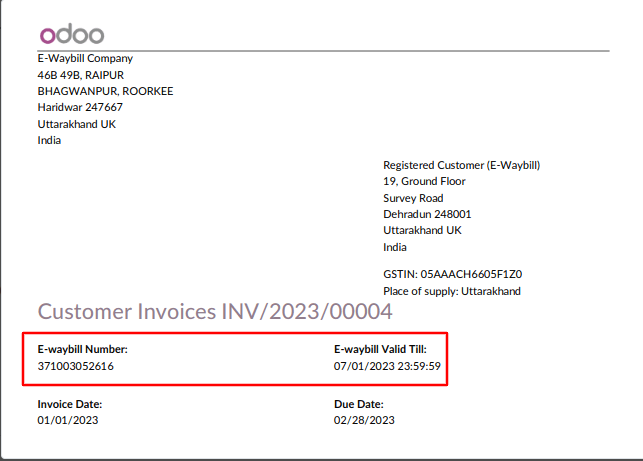

You can print the invoice PDF report once you have submitted the E-Way bill. The report .

includes the E-Way bill number and the E-Way bill validity date.

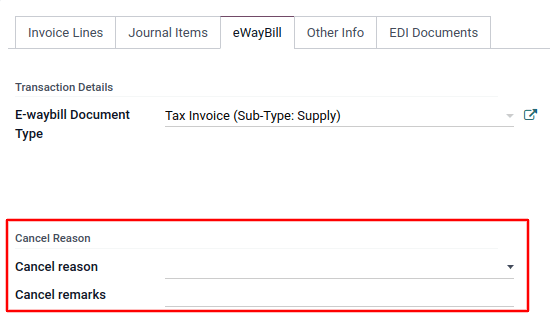

E-Way bill cancellation

If you want to cancel an E-Way bill, go to the E-Way bill tab of the related invoice and fill out the Cancel reason and Cancel remarks fields. Then, click Request EDI Cancellation.

Indian e-invoicing and e-way bill systems are significant milestones in the nation's journey towards a digital economy. Odoo's integrated modules for e-invoicing and e-waybill not only simplify compliance but also enhance business efficiency and tax reporting. By adopting Odoo, businesses can stay ahead of the curve and seamlessly adapt to changing regulatory requirements while focusing on growth and productivity. Embrace the power of Odoo's e-invoicing and e-way bill solutions today and unlock new opportunities for your business!

0