Mubasheera PullatOct. 3, 2024

As businesses worldwide continue to embrace digital transformation, ERP systems like Odoo have become pivotal for managing operations effectively. A crucial aspect of any ERP system is its ability to cater to local market needs, particularly in accounting, legal compliance, and tax management. For Italian businesses, Odoo 18 offers a comprehensive localization package designed to meet Italy's stringent legal and regulatory requirements. This localization ensures that Italian companies not only operate efficiently but also remain compliant with national laws.

What Is Localization in ERP Systems?

Localization refers to the process of adapting software to meet the legal, tax, and accounting regulations of a specific country. Without this essential customization, businesses risk non-compliance, which can lead to fines, penalties, and other legal complications. Odoo 18’s Italy localization package effectively addresses these challenges by ensuring that businesses comply with Italian government regulations. This includes everything from accurate tax reporting and electronic invoicing to implementing country-specific accounting frameworks and generating Italy-centric statutory reports. With Odoo 18, Italian businesses can focus on growth, knowing their operations are aligned with the nation's regulatory standards.

Installing Italy Localization Modules

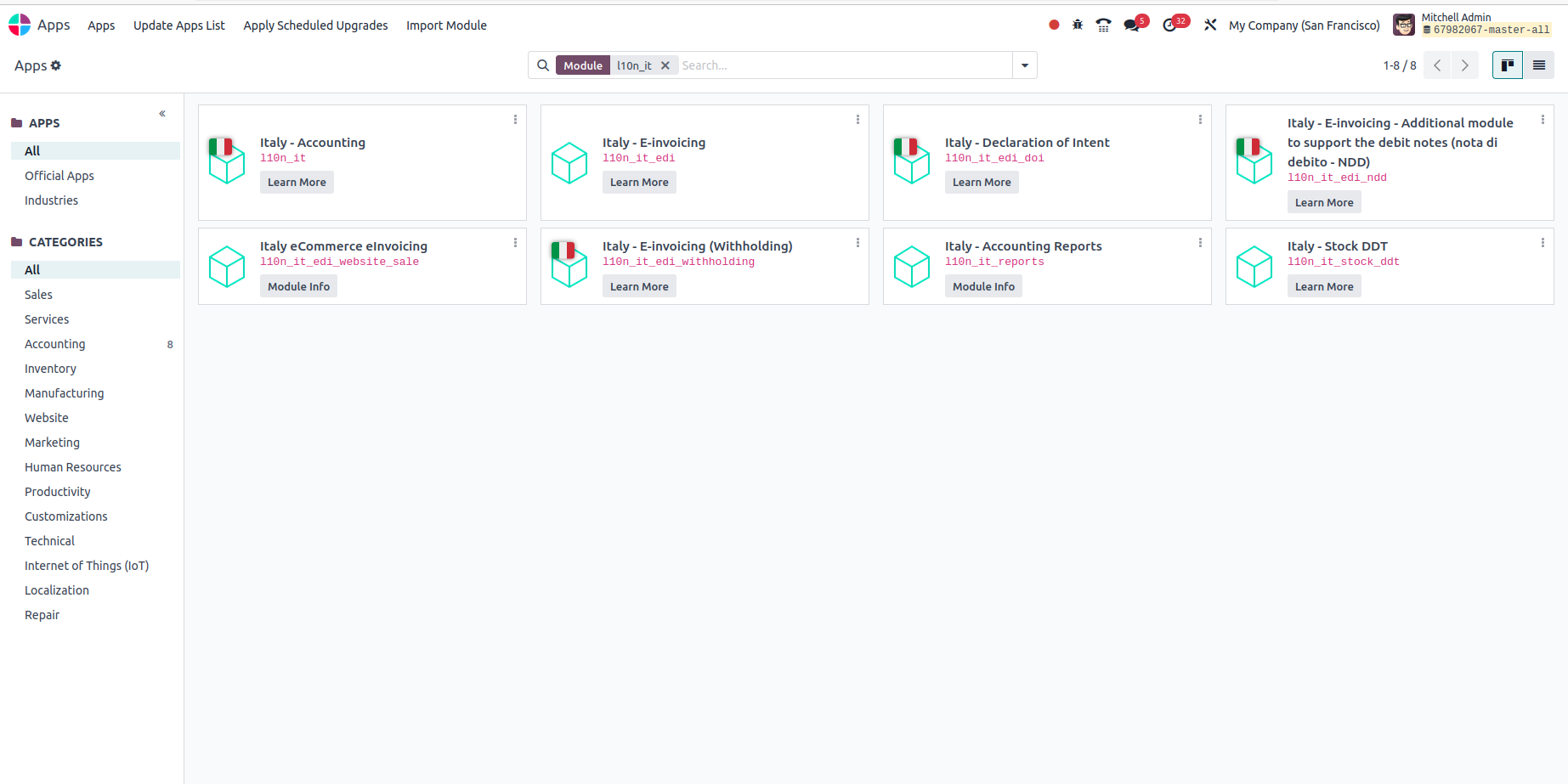

The first step to ensuring your Odoo 18 system is compliant with Italian laws is to install the Italy localization modules. These modules are specifically designed to meet the regulatory needs of businesses operating in Italy. To begin, log in to your Odoo instance and navigate to the Apps menu from the main dashboard. This menu gives access to the wide variety of additional features and modules available within Odoo, including localization packages tailored for different countries.

Once in the Apps section, use the search bar to look for Italy-specific localization modules. You can search using terms like "Italy," "l10n_it," or "localization." Odoo will filter the results to show the relevant modules designed for Italy, such as:

Italy - Accounting (l10n_it): The core module providing the foundation for Italian localization.

Italy - E-invoicing (l10n_it_edi): Manages electronic invoice generation, submission, and compliance.

Italy - E-invoicing (Withholding) (l10n_it_edi_withholding): Handles withholding tax calculations and reporting.

Italy - Accounting Reports (l10n_it_reports): Generates country-specific reports and templates.

Italy - Stock DDT (l10n_it_stock_ddt): Supports the creation and management of transport documents.

Italy - E-invoicing Website Sale (l10n_it_edi_website_sale): Facilitates electronic invoicing for online sales, ensuring compliance with Italian e-commerce regulations.

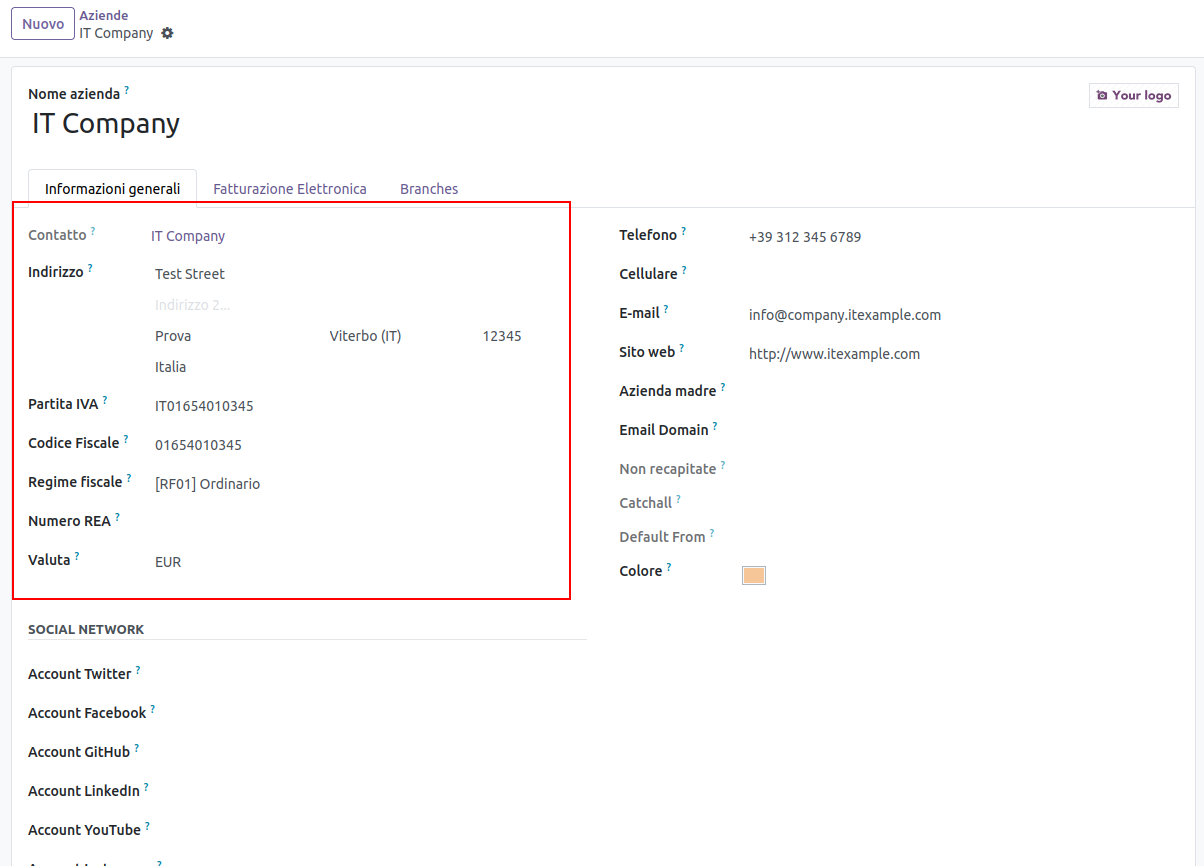

Company Details

Enter your company’s full address, including street, city, postal code, and country. This information is used on invoices and financial documents, ensuring accurate communication and compliance with legal requirements. Input your VAT number to enable correct VAT calculation and reporting, which is crucial for compliance with Italian tax regulations. Provide the fiscal code (Codice Fiscale), a unique identifier for Italian tax and administrative purposes, which is essential for generating compliant documents and reports. Finally, specify your company’s tax system to ensure accurate tax calculations and reporting, reflecting the applicable tax rules and regulations for your business.

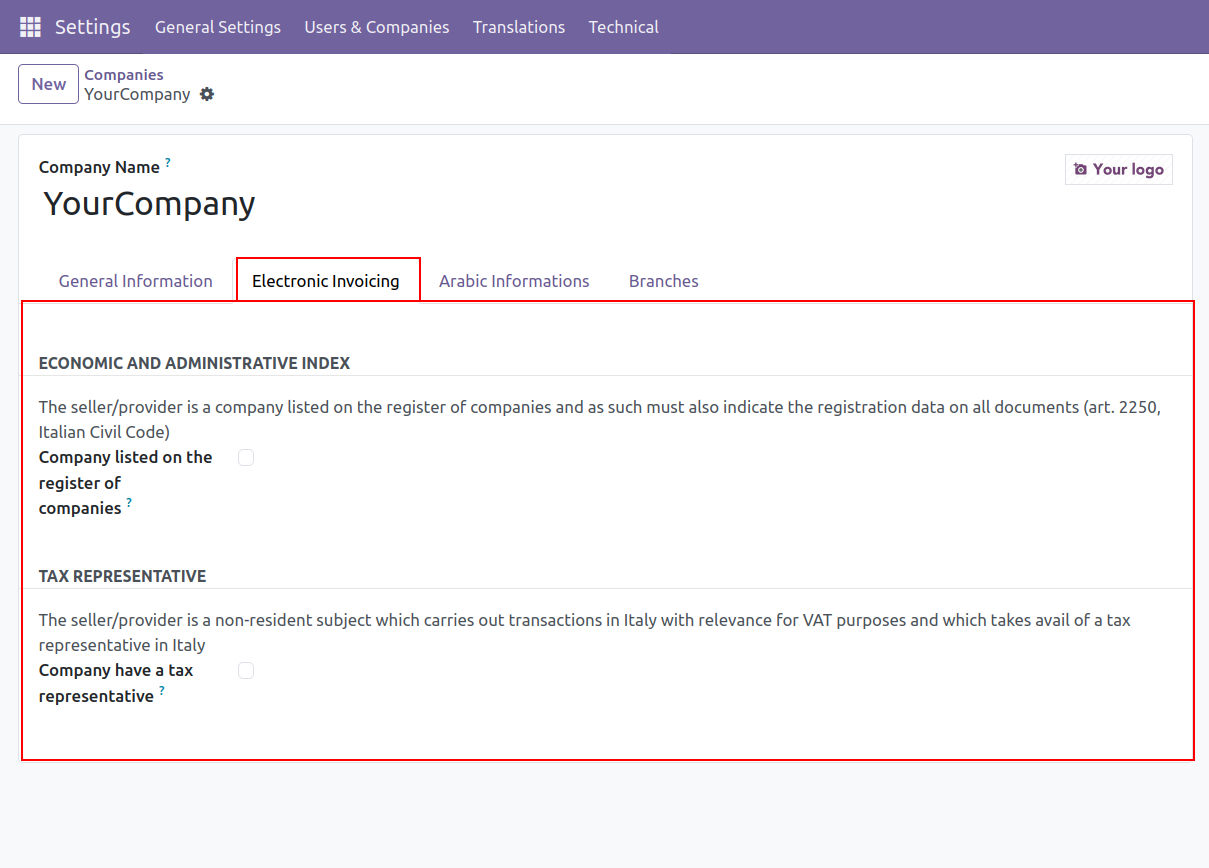

Electronic Invoicing is a part of a registration or setup process for a company operating in Italy.Let's break down the fields and their significance:

ECONOMIC AND ADMINISTRATIVE INDEX

Company listed on the register of companies: This field asks if the seller/provider is a company registered in Italy.the company must indicate its registration data on all documents,as per Article 2250 of the Italian Civil Code.This ensures transparency and compliance with Italian business regulations.

TAX REPRESENTATIVE

Company have a tax representative: This field asks if the seller/provider is a non-resident entity (i.e.,a company based outside of Italy) that conducts transactions in Italy with relevance for VAT purposes and has appointed a tax representative in Italy.A tax representative is a local entity responsible for handling VAT-related matters on behalf of the non-resident company,ensuring compliance with Italian tax laws.

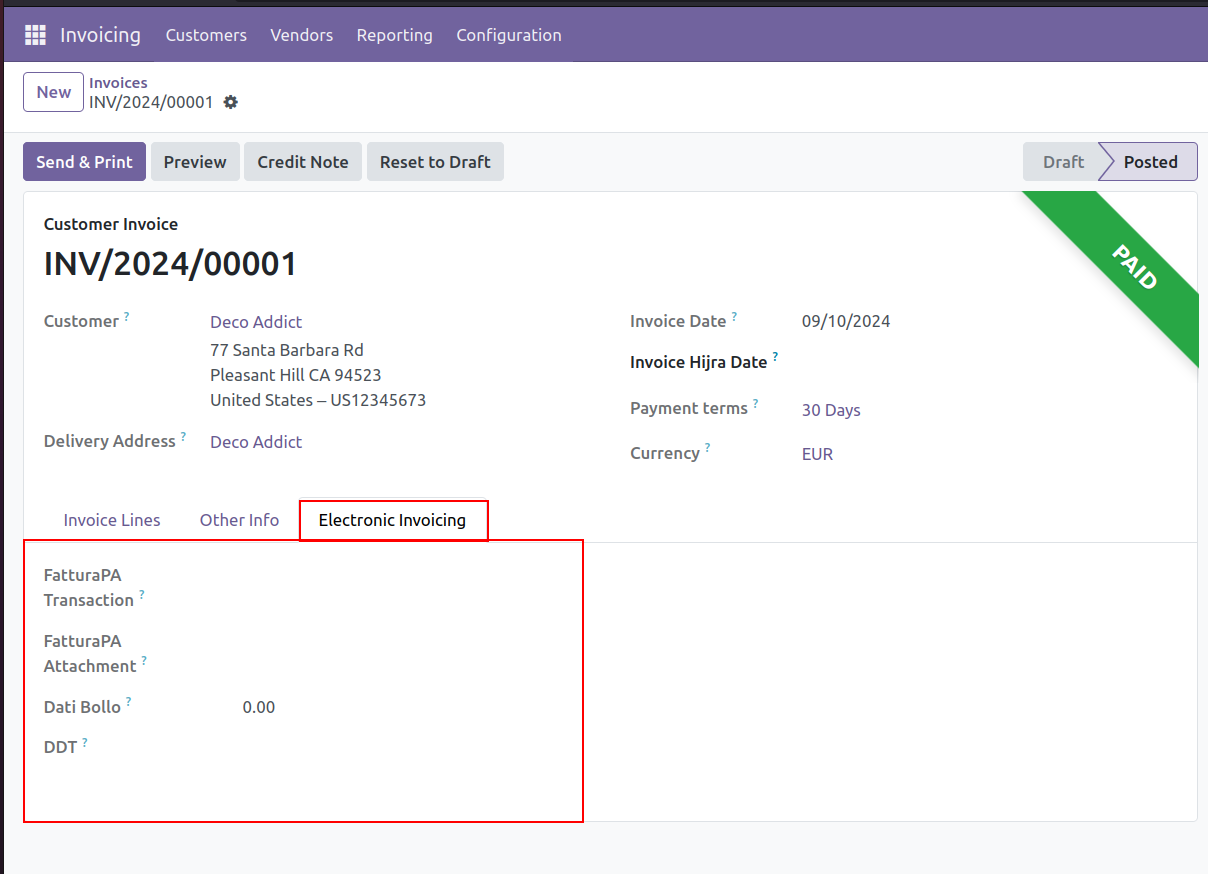

Italian Electronic Invoicing

Odoo provided is an extensive implementation for handling electronic invoicing in the context of Italian regulations. It primarily focuses on integrating FatturaPA, the electronic invoicing system required for transactions in Italy.

in the context of Italian electronic invoicing, the

in the context of Italian electronic invoicing, the FatturaPA Transaction is a unique identifier for tracking an invoice through the SDI system. The FatturaPA Attachment refers to the XML file containing the invoice data, which is submitted to SDI for validation. Dati Bollo captures the stamp duty information required for compliance with Italian tax regulations. The Documento di Trasporto (DDT) is a transport document that accompanies goods during transit, providing essential shipment and delivery details.

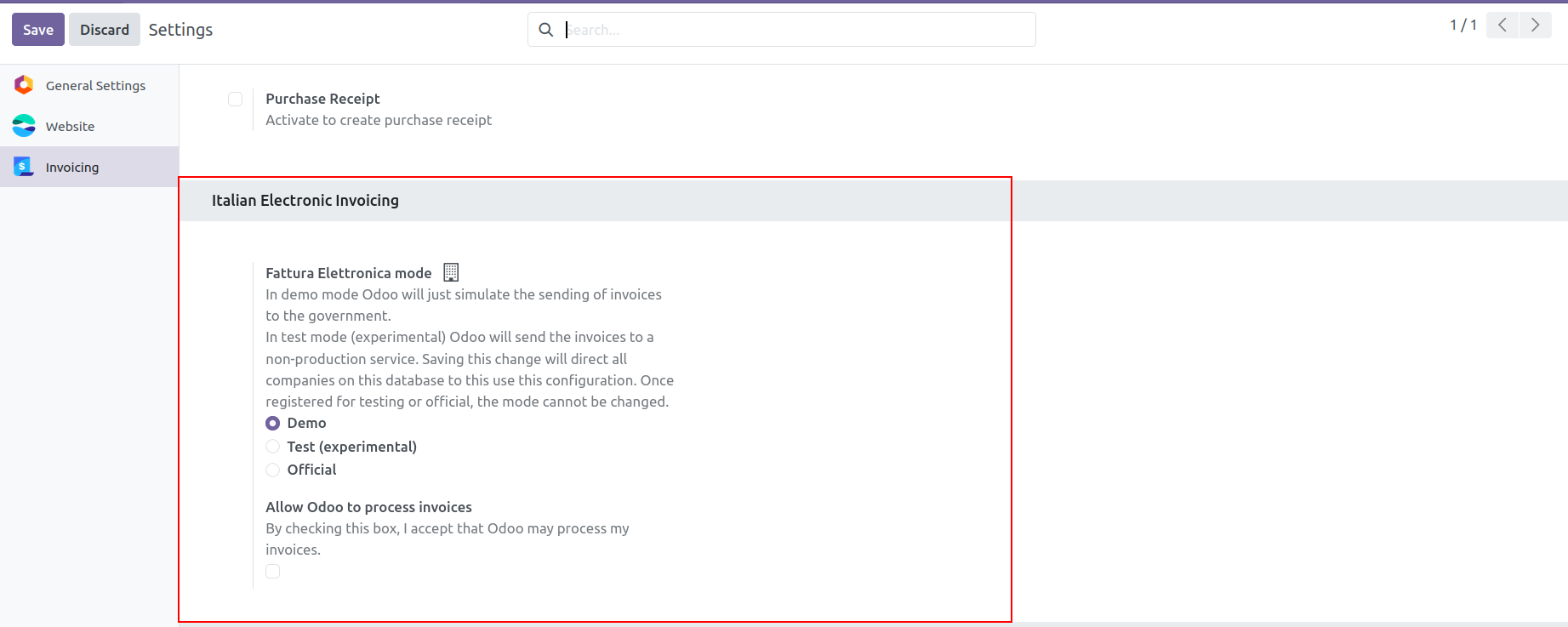

Italian Electronic Invoicing Settings

This allows users to manage Italian Electronic Invoicing settings in Odoo with ease. It offers options to select different EDI modes—Demo, Test, and Official. In Demo mode, Odoo simulates invoice processing, while Test mode interacts with a non-production service, and Official mode handles real invoices.

The user interface provides clear options for configuring these settings, ensuring businesses can align their invoicing processes with their needs and regulatory requirements. It also includes safeguards to prevent changes once a company is officially registered, ensuring compliance and accurate invoicing management.

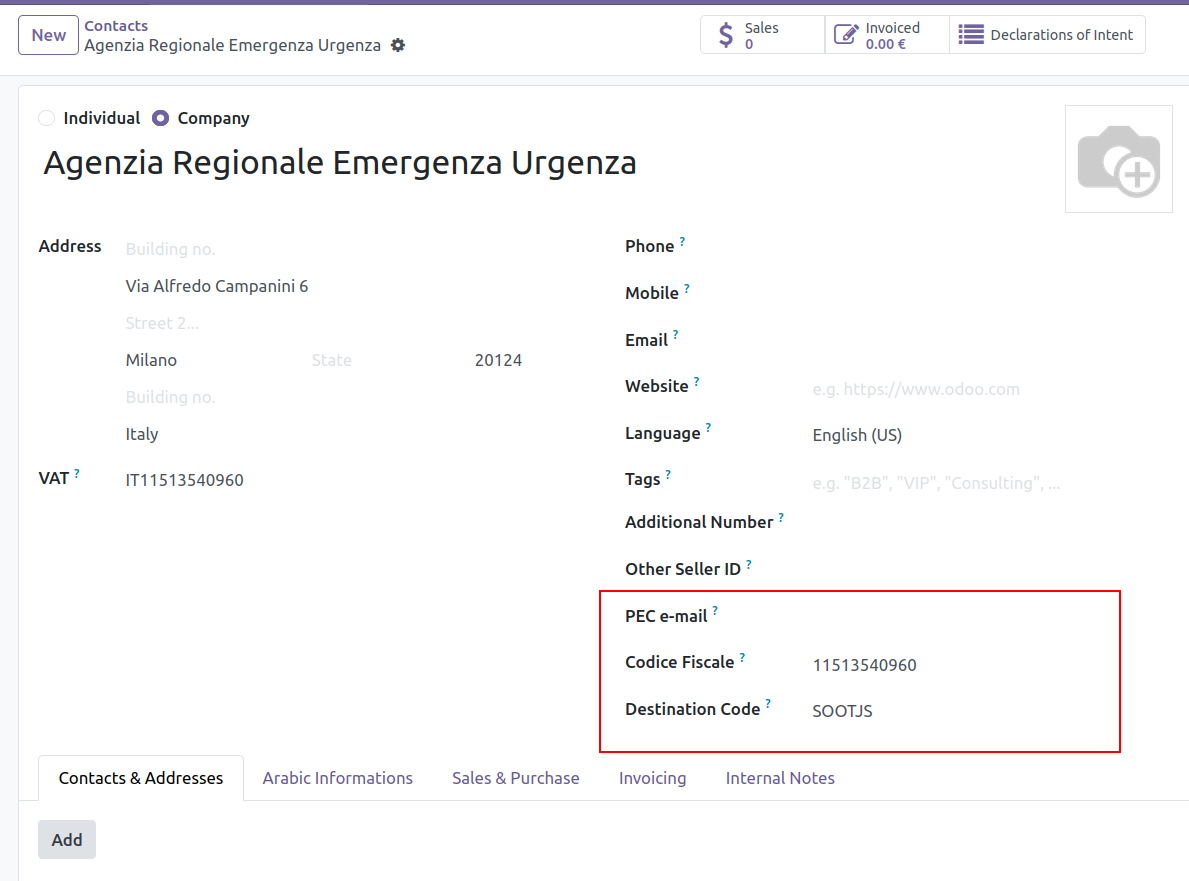

Partners

When using an e-invoicing application in Italy, it's essential to include specific legal details in your customer and vendor profiles to ensure smooth processing of invoices. This involves adding the PEC email address, Codice Fiscale (tax code), and PA Index (a unique code for public administration). The PA Index, which is a 6-7 character code, is crucial as it directs the invoice to the correct government office. In the code provided, fields are added to store these details, and there are checks and validations to ensure they are correctly formatted and complete. This setup helps in generating properly formatted invoices and ensures compliance with Italian e-invoicing regulations.

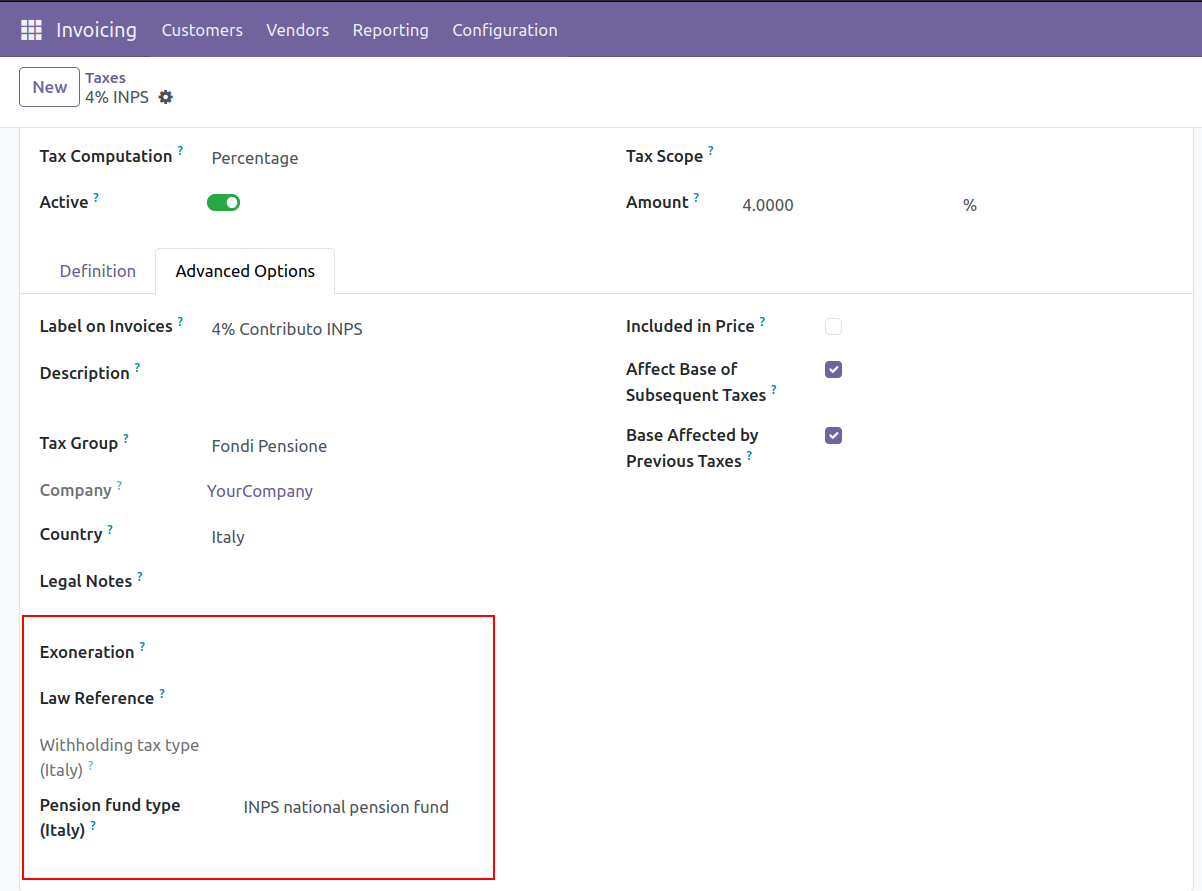

Italian Tax Exonerations

Managing tax exemptions in Italy requires compliance with specific VAT and reverse charge rules. Odoo simplifies this by allowing users to select the appropriate exemption reason and add relevant legal references directly in the tax setup.ensures that the special tax for Declarations of Intent cannot be deleted, maintaining compliance with specific tax requirements.

Exoneration Reason: Enables users to choose from a list of VAT exemption reasons in accordance with Italian tax laws, ensuring proper tax treatment for scenarios like exports or reverse charges.

Law Reference: Allows input of legal references linked to VAT exemptions for clear documentation and audit readiness.

Withholding Tax Type (Italy): Helps select the applicable withholding tax type for a transaction, ensuring accurate tax reporting and compliance with Italian regulations.

Pension Fund Type (Italy): Facilitates recording pension fund contributions in line with Italian regulations, especially for professionals like lawyers and doctors.

Odoo 18's Italy localization package offers a robust solution for Italian businesses, ensuring compliance with local regulations while streamlining financial and operational processes. By incorporating features such as electronic invoicing, tax exonerations, and detailed company profiles, Odoo helps businesses navigate the complexities of Italian law efficiently. With the right setup, Odoo 18 not only enhances operational efficiency but also provides peace of mind, knowing that your business is in full compliance with Italian regulatory standards.

0