Muhamed YasirSept. 20, 2017

Tax Deducted at Source or TDS is a type of tax that is deducted from an individual’s income on a periodical or occasional basis. TDS can be applicable for income that are regular as well as irregular in nature. Income Tax Act, 1961 regulates TDS in India through Central Board of Direct taxes (CBDT) under the Indian Revenue Services (IRS). TDS rule directs the payee or employer to deduct a certain amount of tax before making full payment to the receiver. TDS is applicable for salary, commission, professional fees, interest, rent, etc.

Payments such as salaries, interest payment, commission, fees to lawyers and freelancers etc. are subject to TDS. For salaries, the percentage of TDS will be based on income slabs rates. Similarly, each type of income has its own percentage of tax that calculates when the amount meets certain limit.

TDS collection at source without the calculation of investment onward that is eligible for tax deductions, hence, an individual can declare and submit his investment proof in order to file a return and claim for the TDS refund.

In order to calculate TDS from salary, you will need to calculate the total gross income from salary as well as other sources, then calculate all the investments and exemptions. Once you have calculated the total amount, you can reduce the allowable investment and exemptions from your salary, this will give you your annual income that will be taxed on the various income slabs.

TDS Return Due Date

TDS return and last dates of FY 2017-18

| Quarter | Quarter Period | Last Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July, 2017 |

| 2nd Quarter | 1st July to 30th September | 31st Oct, 2017 |

| 3rd Quarter | 1st October to 31st December | 31st Jan, 2018 |

| 4th Quarter | 1st January to 31st March | 31st May, 2018 |

If an individual has paid excess TDS when compared to the liable tax amount, the deducted or payee can file a claim for a refund of the excess amount. Calculation of TDS deductions based on various factors for individuals from different types of income categories.

TDS is not collected on payments made to the Reserve Bank of India, the Government of India etc. TDS will not be collect when interest is credited or paid to:

*Central or State Financial Corporations.

*Banking companies.

*Interest paid under Direct Taxes or refund from the IT department.

*UTI, LIC and other insurance or co-operative societies.

*Interests earned from recurring deposit or savings account in cooperative societies or banks.

*Interest in Indira Vikas Party, KVP, or NSC.

*Interest earned in NRE account.

*All institutions notified under no-TDS.

*Apart from these, there are other avenues also where TDS may not be applicable, such as interest on compensation from MVCT (Motor Vehicles Claims Tribunal). Therefore, taxpayers need to check if their interest income is liable for TDS with a particular institution or not.

Refund of Excess TDS Deductions

If a person has been subjected to excess TDS deductions, the deductor can make claims for refund of the excess amount. The difference between the tax deducted and the actual payments made with the deductor, whichever is higher, is accepted as the excess payment, and this amount will be refunded after adjusting against any tax liabilities under Direct Tax Acts.

As TDS collection is in an ongoing basis, it can be difficult to keep track of deductions with an individual. As per Section 203 of the ITA, the deductor has to furnish a certificate of TDS payment to the deductee/payee. Banks also give this certificates for making deductions on pension payments etc. The certificate is typically issued at the deductor’s own letterhead. Individuals need to request for TDS certificate wherever applicable, and if not already provided.

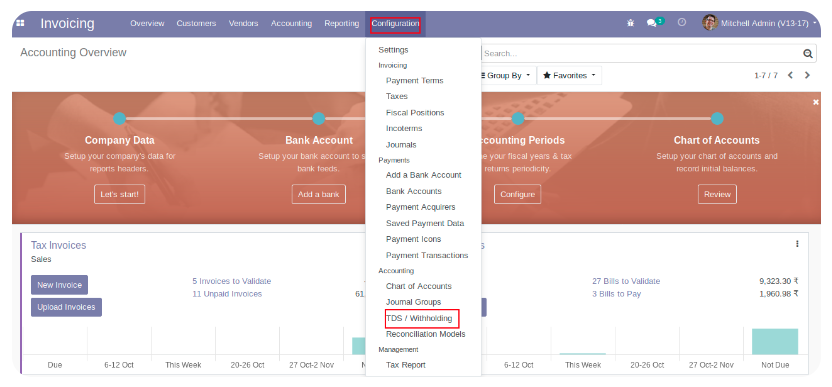

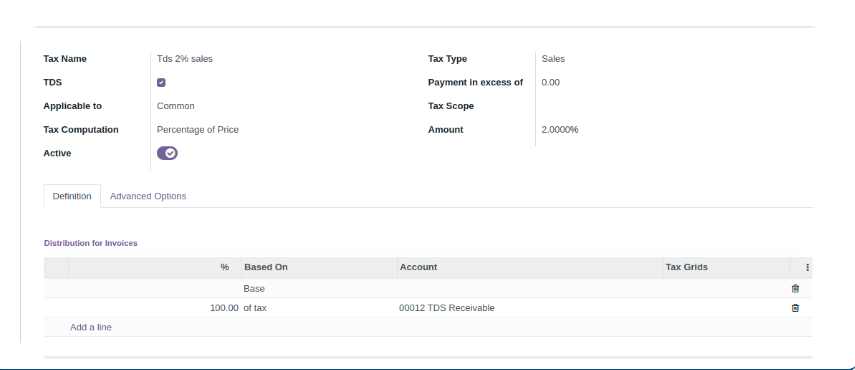

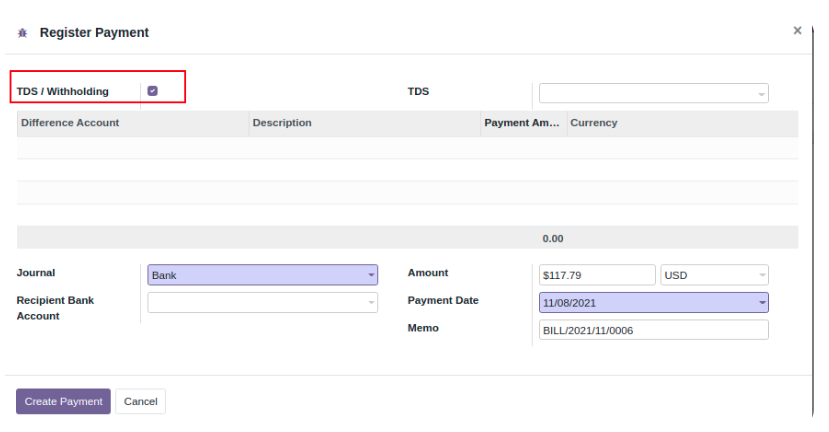

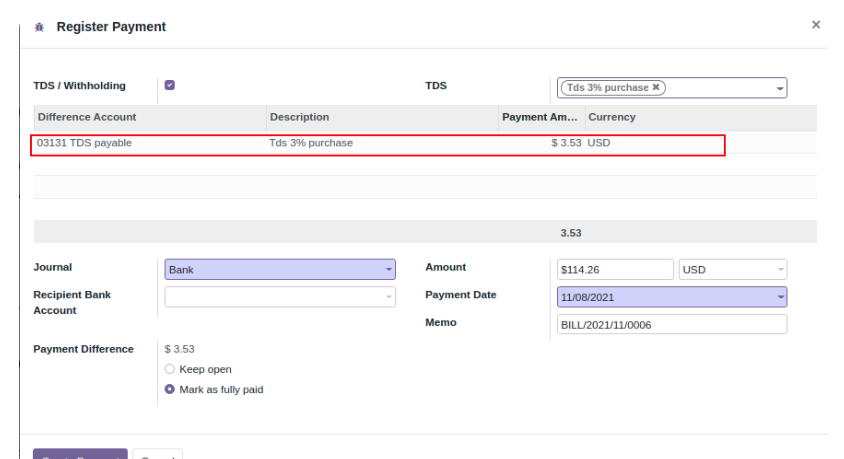

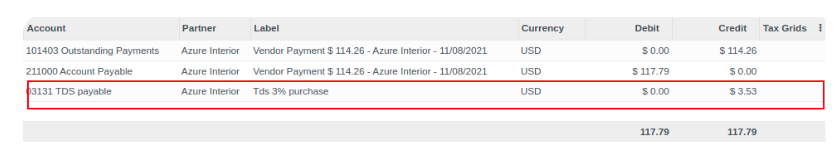

This is one of the essential feature in almost all accounting system. Most of the common accounting softwares have this feature. The TDS tax in Odoo module developed by Technaureus a software development company in Calicut and ERP Implementation partner, we will helps the users to get this TDS handling facility in your Odoo system.

0